tax credit survey ey

Tax and Finance Operations Survey. The Date of Birth DOB field does not allow.

Becaue the questions asked on that survey are very private and frankly offensive.

. EY has published a new survey as part of its Future of VAT project. EY brings the multifunctional tax technical capabilities and experience of our Employment Tax Tax Credits and Compensation Benefits practices to assist our clients during this unique time. Select the Tax Credit Check task.

Posted by 1 year ago. Theyre asking for my ssn for a tax credit survey. How blockchain is helping make every blood donation more effective.

The 2022 EY Tax and Finance Operations Survey TFO survey which queried 1650 executives in more than 40 jurisdictions and a dozen industries has found that organizations are having to find a balance between driving value managing risk and reducing cost. EY is at the forefront of the ERC - Our National Tax office has been working closely with the Government agencies to fully understand and assist employers with the. Theyre asking for my ssn for a tax credit survey.

Im filling out an online job application chilis. Click Take Survey to answer the questions and follow the prompts until. Enter the required information.

Click Finish to receive final instructions. We request that you complete the following survey to determine if our company may be eligible for tax credits based on our hiring practices. About the survey.

A date older than 130 years. 2 The tax credit benefit can range from 2400 to 9600 depending upon the employees category of eligibility. Finance Act 2019 introduced changes to the RD tax credit regime that predominantly focuses on small and micro companies.

The Tax and Finance Operations Survey provides insight on how transforming tax and finance functions can bring more value to an enterprise. Yet they are attempting this even as they face challenges retaining and. The WOTC survey displays in the current browser window.

Among the attendees at the EY 36 th Annual International Tax Conference the 355 survey respondents represent senior. Our company participates in a federal employment initiative called the Work Opportunity Tax Credit WOTC. Replacing the version published in June 2019.

A date in the future. Many businesses of all sizes but especially the very largest have not fully adjusted to ongoing dramatic changes in tax authority scrutiny of their affairs according to respondents to EYs 2021 Tax Risk and Controversy SurveyAnd change may be far from over. 53 of tax leaders expect greater enforcement in the next three years especially as governments begin to.

Multinational organizations need access to real-time global data that offers clear insights into opportunities obligations and risks. We invite you to discuss the results and insights of the 2020 Tax and Finance Operate Survey. The website on the search bar is wotcgsey.

How to build supply chains resilient to disruption. Complete WOTC survey process record confirmation number and print forms if applicable Upon completion of the survey a Survey Complete page will appear. EY helps clients create long-term value for all stakeholders.

Take WOTC survey. EY refers to the global organization and may refer to one or more of the member firms of Ernst Young. Are employers participating in the employee Social Security tax deferral program.

These were measures for which various bodies and interested parties had been calling for over the last few years and. EMPLOYER WILL NOT SEE YOUR RESPONSES. The EY Global Tax Platform GTP redefines how tax operates offering an innovative end-to-end platform that supports all your tax business solutions.

The tax survey is complete. 18 Mar 2020 Consulting. RD Tax Credit guidelines in July 2020 1.

Enabled by data and technology our services and solutions provide trust through assurance and help clients transform grow and. As we previously reported EY Tax Alert 2020-1199 the IRS has now released a draft Form 941 and instructions that starting with the 2020 second quarter provide the details necessary for claiming the federal COVID-19 tax credits including the employee retention credit. On August 28 2020 the IRS in Notice 2020-65 responded to a Presidential Memorandum executive order by giving employers the option 1 to delay their withholding of the 62 employee share of Social Security and the comparable Railroad Retirement tax for certain.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. Big companies want the tax credit and it might be a determining factor in selecting one applicant over another.

The website on the search bar is wotcgsey. Understandably the Form 941 reporting process is complex and includes a new Worksheet 1. Let me ask you I promise not to do anything bad with your SS want to post it on CD we know the answer already.

2 Mar 2020 Purpose. This is the Ernst Youngs vendor survey site.

Chief Economist Norway S Housing Market Rally Is Over Nordea

General Survey Job Application Surveys How To Apply

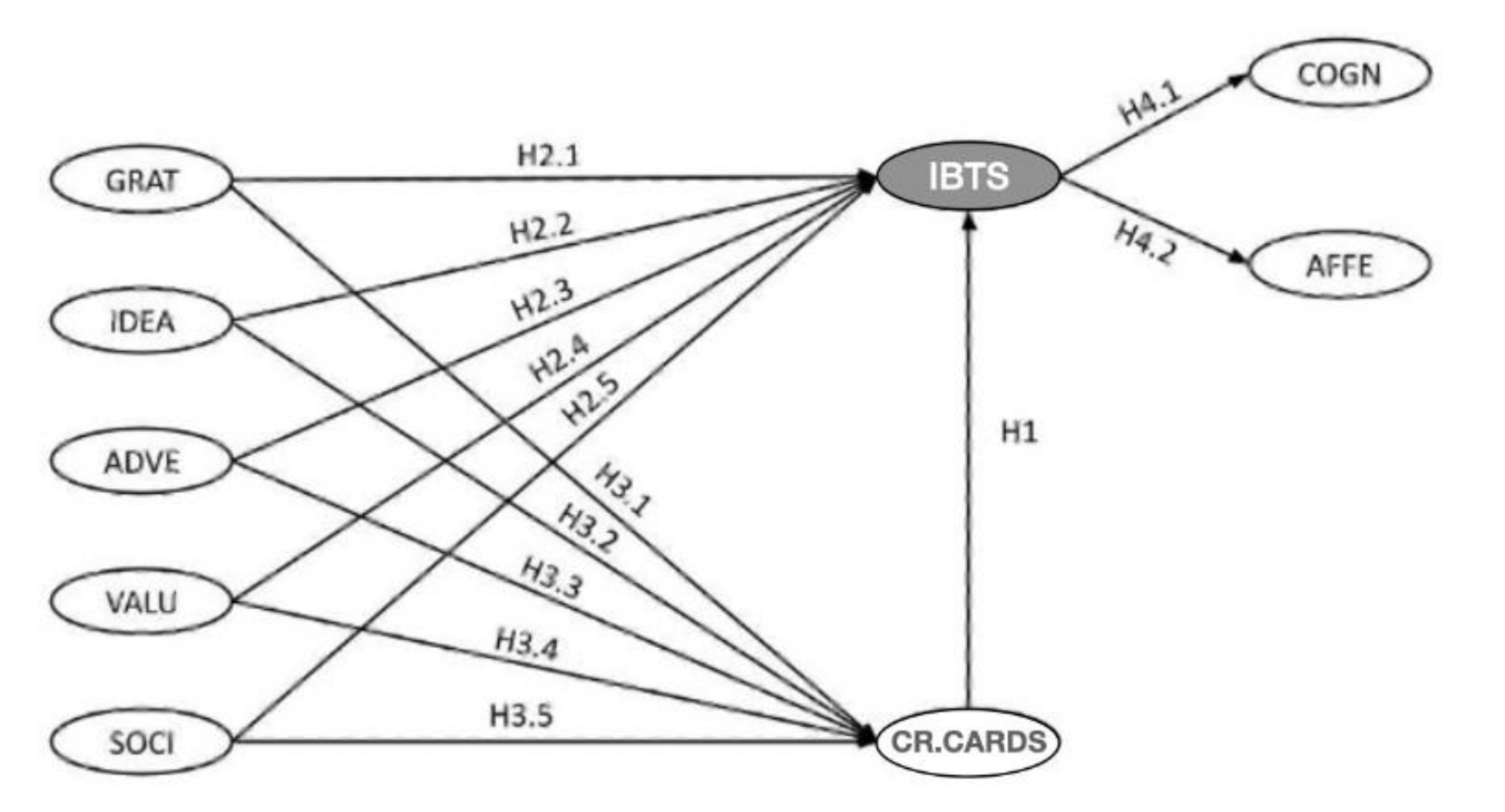

Sustainability Free Full Text Credit Card Use Hedonic Motivations And Impulse Buying Behavior In Fast Fashion Physical Stores During Covid 19 The Sustainability Paradox Html

Ey Outlines Blockchain Technologies Legal Impacts Earth At Night Blockchain Technology Earth

What To Expect From Le Tour De France

Ey S 2022 Tax Policy And Controversy Outlook Ey Global

How Le Tour Femme Is Taking Shape

General Survey Job Application Surveys How To Apply

Redefining Sme Banking In A Post Pandemic World

Design Logo For Progressive Work Environment Logo Branding Identity Logo Design Logo

7 Things You Need To Know About Investing In Company Stock Finance Advice Investment Tips Finance Investing